Moving to the Canary Islands, Madeira or the Azores: how it really works

Moving to a European island works a little differently

Dreaming of life on an island is easy. Arranging your move to that island is a different story. Many people think: Spain is Spain and Portugal is Portugal. But moving to Canary Islands is very different from moving to the Madeira or the Azores. Not in terms of atmosphere, but in terms of regulations, customs and taxes.

Those who don’t know these differences can quickly get stuck in paperwork, extra costs and delays. We’ll show you how it really works.

Canary Islands: Spanish, but outside the EU

The Canary Islands politically belong to Spain, but they fall outside the EU VAT and customs territory. As a result, a move to the islands is treated as an export from the Netherlands and an import on the island.

This means in practice:

NIE number required

Anyone who wants to settle in the Canary Islands needs a NIE-number (Spanish tax identification number). Without a NIE number:

❌ No import possible

❌ No exemption can be requested

❌ No personal belongings can be imported

You apply for the number through the police station or the consulate. To carry out an import, the NIE number must also be registered with the Spanish tax authorities using a Modelo 030 form. It may sound minor, but administratively it is a key element in the entire process.

What about import duties?

Import duties only apply when goods are imported based on value using a NIE number, not when an exemption applies. The Canary Islands have their own tax regime.On average, you pay about 7% tax on the customs value of your goods.

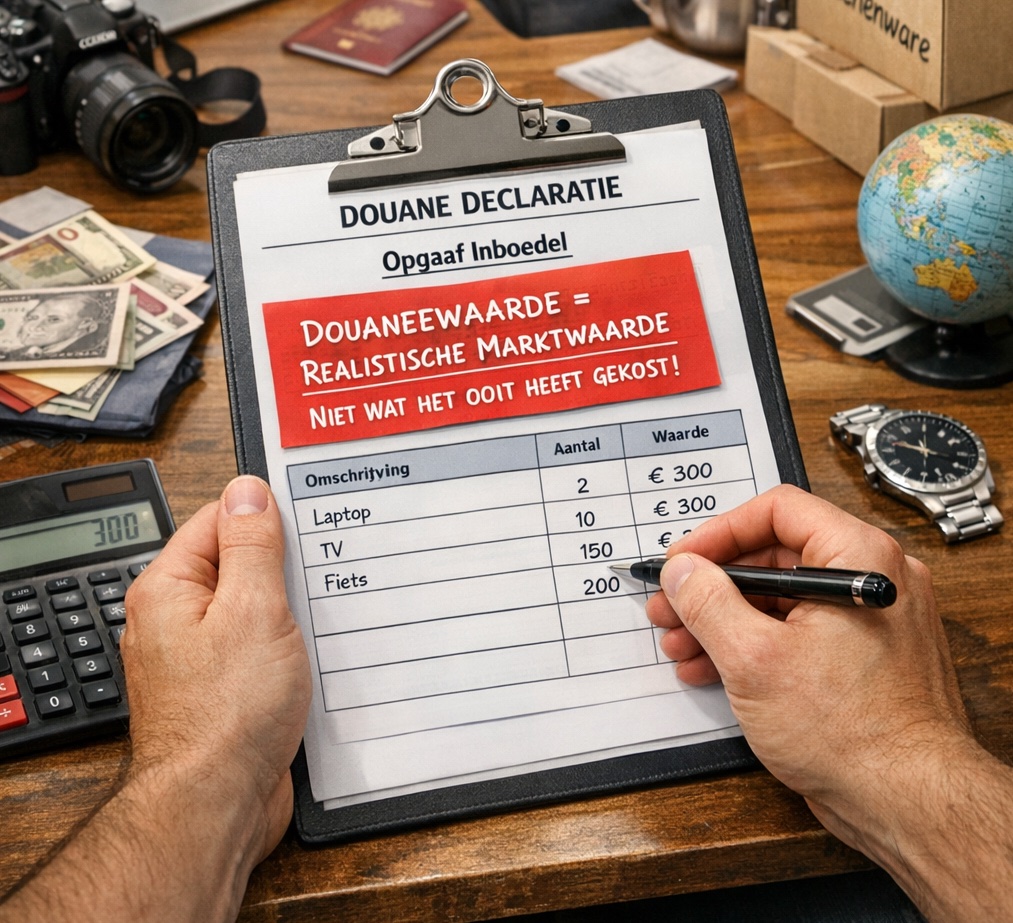

Important: customs value does not mean “what it once cost,” but a realistic market value—comparable to what it would sell for on a second-hand marketplace.

New items = higher charges. Used household goods = usually limited charges.

Madeira and the Azores: EU members, yet still customs

Madeira and the Azores belong to Portugal and therefore fall within the European Union. You do not need to prepare export documents as you do for the Canary Islands, but it is not completely “free movement” either.

A so-called simplified customs procedure applies. What still applies:

- Transit document

- Registration via a Portuguese NIF number

- Customs clearance on location

- Documentation check

What no longer applies:

- Import duties

- Export status (including the possibility to reclaim paid VAT)

- Non-EU levies

In addition, a special VAT arrangement applies to transport. Transport services to these islands are subject to 0% VAT.

How does your household goods get to the island?

For island moves, Halo works with two main options:

1. Groupage (shared container transport)

Smaller shipments are combined with other moves in one container. Goods are placed on pallets and sealed or transported in crates. Containers usually depart every one to two weeks.

2. Private container

For larger moves, a full container is often more cost-effective. This is ideal for large furniture, long tabletops, dark materials, and kitchens with stone countertops. A container can be loaded at your home or via a moving company.

Arrival on the island: what happens next?

After arrival, customs inspection takes place, followed by customs clearance, release of the shipment, and, if applicable, onward transport to another island.

You can collect the shipment yourself or have it delivered to your home. On almost all islands, we work with fixed local agents who handle customs formalities, take care of communication, and arrange delivery if required.

Hans is the founder and former owner of Halo Removal Logistics. With his enormous professional knowledge in the field of emigration and export, he is our walking encyclopedia.